what is an example of an ad valorem tax

Ad valorem taxes are taxes determined by the assessed value of an item. What is an example of an ad valorem tax is.

County Voters To Go To Polls For 6 Millad Valorem Tax

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

. An ad valorem tax is a tax that is based on the assessed value of a property product or service. What is an example of an ad valorem tax is. The most common ad valorem tax.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. One of the most common examples of an ad valorem tax is property. Ad Valorem Tax.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. An example of an Ad Valorem Tax Property tax is a form of ad valorem tax levied on the value of the real estate or other residential and commercial properties paid by the. Ad valorem tax examples.

What is an example of an ad valorem tax is. What is an example of an ad valorem tax is. Ad valorem taxes are those which are levied on spending and which are set as a percentage of the value added by a firm Value Added Tax VAT is an example of an ad.

The most common ad valorem tax. About 4000 were thus annually imported and an ad valorem duty was levied by the. What is an example of an ad valorem tax.

What is an example of an ad valorem tax is. Ad valorem sentence example. An ad valorem tax is expressed as a percentage.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Imports are charged 8 exports 1 ad valorem duty. Local government entities may levy an ad valorem tax on real estate and other major personal property.

The most common ad valorem tax. The most common ad valorem tax. What is ad valorem tax example.

A 20 ad valorem tax increases production costs by. An ad valorem tax is a tax that is based on the assessed value of a property product or service. The most common ad valorem tax.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. The most common ad valorem tax examples include property taxes on. An ad valorem tax is a tax that is based on the assessed value of a property product or service.

The most common ad valorem. Ad valorem taxes are commonly used with real estate personal property or other goods and services. A good example of the ad valorem tax is a local property tax which is assessed annually on the value of an owners residence and property.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. 3 Examples of Ad Valorem Taxes. For example VAT is charged at a rate of 20 in the UK.

One prime example is the Value Added Tax VAT which varies in percentage depending on the. What is an example of an ad valorem tax.

Barrow County Georgia Tax Rates

Indirect Taxes 2021 Revision Update Economics Tutor2u

Personal Property Tax Bill City Of Racine

How To Read Your Property Tax Statement Snohomish County Wa Official Website

What Is Ad Valorem Tax Explained All You Need To Know

Property Tax Definition What It S Used For How It S Calculated

Ad Valorem Tax 3 Examples Of Ad Valorem Taxes 2022 Masterclass

Ad Valorem Tax Definition Uses And Examples

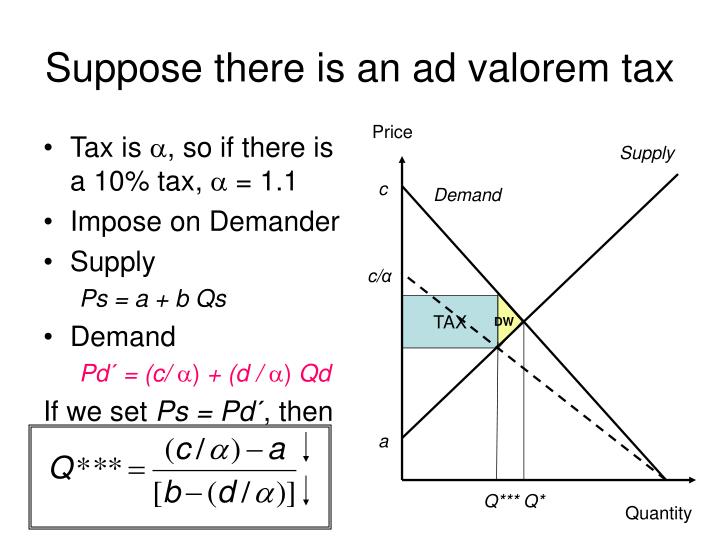

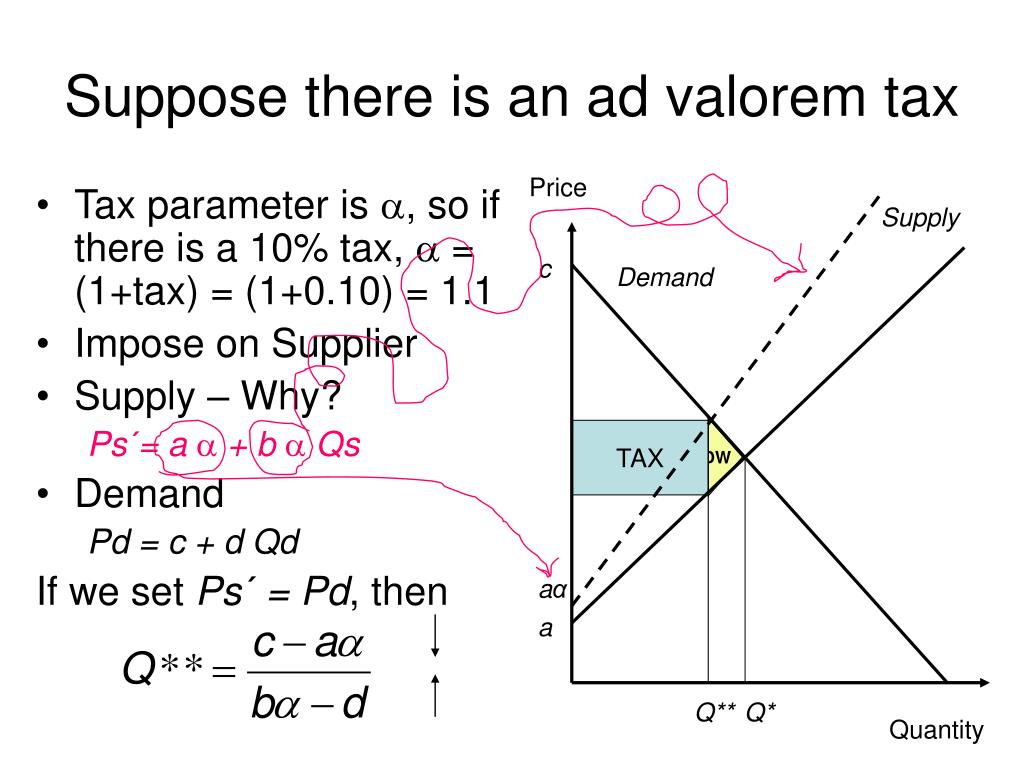

Ppt Incidence Of Ad Valorem Taxes Powerpoint Presentation Free Download Id 246684

Specific Taxes Ad Valorem Taxes Direct And Indirect Taxes Youtube

Ad Valorem Tax Definition And How It S Determined

Understanding California S Property Taxes

Indirect Taxes And Subsidies Edexcel Economics Revision

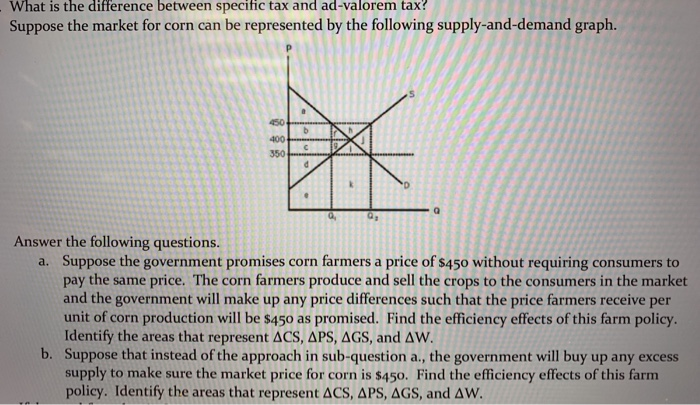

Solved What Is The Difference Between Specific Tax And Chegg Com

Property Tax Explanation Pend Oreille County

Chains Of Reasoning And Building Higher Analysis Marks Economics Tutor2u

Ppt Incidence Of Ad Valorem Taxes Powerpoint Presentation Free Download Id 246684