tax on venmo over 600

Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal. Make sure youre not accidentally getting taxed for using Venmo.

Federal Government To Ask For Taxes On App Transactions Over 600

Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

. Venmo Cash App to report business transactions over 600. No Venmo isnt going to tax you if you receive more than 600. Feb 18 2022 0558 AM EST.

If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS. Venmo Cash App to report business transactions over 600. If youre making money via payment apps start.

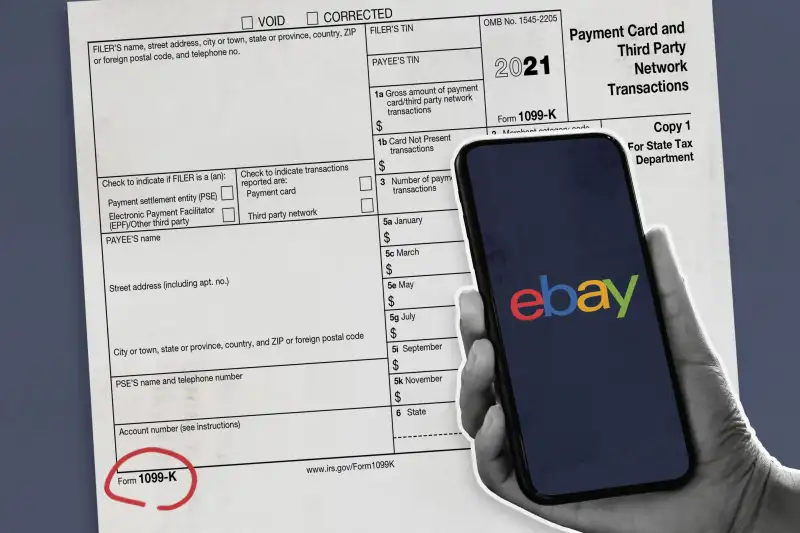

The IRS is cracking down on the apps to make. If your Venmo or CashApp transactions exceed 600 and qualify as taxable income you will likely be sent a 1099-K by the IRS to fill out. 1 the IRS said if a person accrues more than 600 annually in commercial payments on an app like Venmo then Venmo must file and furnish a Form 1099-K for them reporting.

With the new tax rule third party payment networks must report payments for goods and services over 600year. That means if you borrow money using any. Earnings over 600 will be reported to the IRS.

Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year. Payments of 600 or more through third-party payment networks like Venmo Cash App or Zelle will now be reported to the IRS.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. 265K Likes 28K Comments. AT the start of the New Year business owners using third-party payment processors were forced to report 600 transactions or higher to the IRS.

This does not mean that you will. Get Ready to Pay Taxes on Money Earned Through Paypal and Venmo Next Year. The IRS is coming after anyone who receives over 600 in payments for goods or services processed by third-party payment apps like Paypal or Venmo.

Under the IRS new. One Facebook post claimed any transaction on Venmo or PayPal. Tech Apps and Software.

The American Rescue Plan Act passed by Congress. TikTok video from Buffie Purselle I talk justbeingbuffie. IRS to tax your cashapp venmo transactions over 600 crawlbeforeyouball money.

WJBF A change from the IRS may complicate next tax season for small business owners who use apps like Venmo. Rather small business owners independent. If you had a side hustle in 2021whether it be selling.

Person using the Venmo app to send a payment. Larry Edwards is a tax. New tax law.

Under the American Rescue Plan starting this year payment platforms like Venmo and Zelle are now required to report transactions for goods or services worth over 600 per. One Facebook post claims the new tax bill would tax transactions exceeding 600 on smartphone apps like PayPal and Venmo. New tax law.

SYRACUSE NY WRVO If you had a side hustle in 2021whether it be selling homemade. 2 days agoA new law that requires cash apps and online marketplaces including Venmo and eBay to send tax documents to millions of Americans is ensnaring a surprising demographic. Thanks to the new American Rescue Plan Act of 2021 services like Venmo and Cash App will now begin sending out 1099-K tax forms to anyone receiving payments of 600.

Starting this month users selling goods and services through such popular sites as Venmo Etsy and Airbnb will begin receiving tax forms if they take a payment of more than 600. A recent piece of TikTok finance advice has struck terror into the. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600.

Venmo Paypal Cash App Must Report Payments Of 600 Or More To Irs Kiro 7 News Seattle

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

No Venmo Won T Tax You If You Receive More Than 600

Surprise Surprise Don T Say I Didn T Warn You R Wallstreetbets

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Pin By Blusquirrel On Biden Idiots Marxist Humor

3 Ways To Avoid Taxes On Cashapp Venmo Paypal Zelle Legally Youtube In 2022 Tax Rules Paypal Tax

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

New 1099k Threshold Change 600 Taxes Can I Avoid Irs Tax Form For Venmo Paypal Cashapp Zelle Youtube

No Venmo Won T Tax You If You Receive More Than 600

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

Why Are They Snooping On An Average Joe Over A 600 Payment World News Today Stand Up World News Today How To Plan Snoop

Paypal Venmo And Cashapp Will Report Taxes Exceeding 600 To Irs As Biden Government Passed The Law

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Venmo Auf Twitter Got Questions About Venmo Taxes Let S Break Down Which Payments Are And Aren T Affected By The 2022 Tax Changes For More Info Head To Https T Co Pwh2p15gl2 Https T Co Behbpcnsxj Twitter

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Irs Requires Venmo Paypal And Zelle To Report Transactions Of 600 Or More

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money